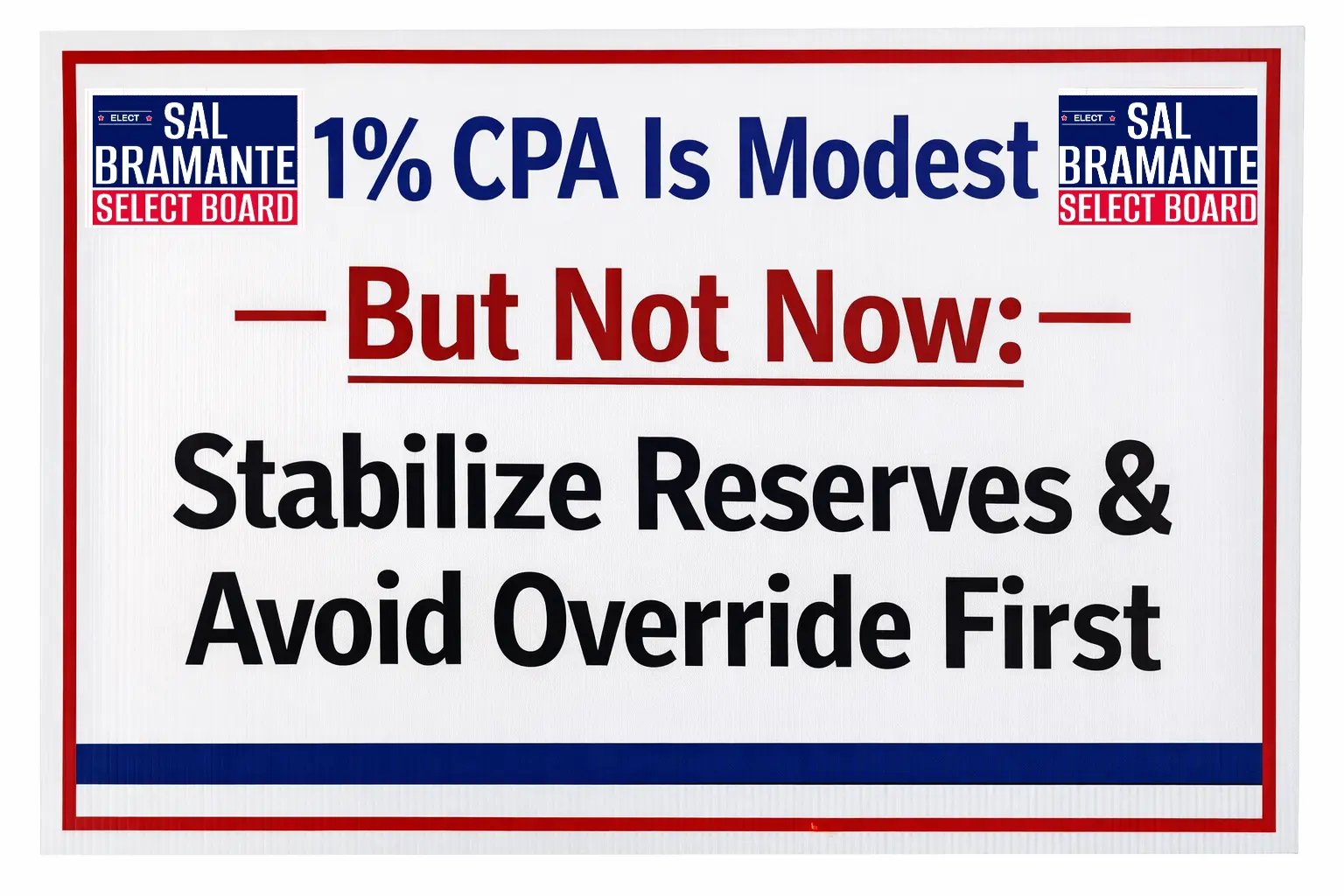

The Community Preservation Act (CPA) offers a dedicated funding stream for open space, historic preservation, outdoor recreation, and affordable housing, with a state match (historically 14–39%, currently around 18%). The Ad Hoc CPA Study Committee has unanimously recommended a 1% surcharge on property taxes (with targeted exemptions for vulnerable residents), projecting roughly $790,000 in annual local revenue (based on FY25 values), plus state matching funds — a modest rate compared to the maximum 3% allowed.While this 1% goal is a reasonable starting point in concept, and the Committee’s work has been thorough, now is not the right time for Reading to move forward with adoption. The town faces overlapping fiscal pressures that would make adding even this modest permanent surcharge burdensome:

- Free cash reserves are depleting rapidly — dropping from $17.3 million (end of FY25) to ~$13.6 million (end of FY26) and projected to fall further ($9 million by FY27) due to rising accommodated costs outpacing the 2.5% levy limit, creating a structural operating deficit and increasing the likelihood of a permanent Proposition 2½ override in the near future.

- Voters recently approved two major capital debt exclusions (Killam School replacement and Reading Center for Active Living), adding temporary but significant tax increases (phased in over 15–20 years, ~$500–$600+ annually for the average home once fully implemented).

Layering on a new permanent 1% CPA surcharge — even with exemptions — would add another ongoing cost (~$90–$100/year for the median home) at the worst possible moment, when families are adjusting to capital project impacts, reserves are being used as a budget crutch, and operating expenses continue to climb.As your Select Board candidate, I will:

- Oppose advancing the CPA to the November 2026 ballot on the current timeline (e.g., via an April 2026 Town Meeting vote to place the question).

- Support continued study and community dialogue — but delay any adoption until after stabilizing the operating budget, rebuilding free cash reserves, and assessing the real-world tax impact of the Killam and ReCal projects.

- Advocate for fiscal priorities first — focus on cost controls, efficiencies, revenue maximization (e.g., grants, state aid), and avoiding/minimizing a permanent override before introducing another dedicated tax.

- Insist on resident protections if pursued later — including a low rate like 1% (or less), strong exemptions for seniors/low-income households, and clear allocation guidelines to ensure funds address true community needs without redundancy.

Reading values open space, history, recreation, and housing — but we must sequence these investments responsibly to keep taxes affordable during this challenging period. I’ll be the voice for smart timing and taxpayer relief on the Select Board.